3 Simple Techniques For Feie Calculator

Table of ContentsFeie Calculator for BeginnersThe 5-Second Trick For Feie Calculator8 Simple Techniques For Feie CalculatorNot known Factual Statements About Feie Calculator Feie Calculator - Truths

He sold his United state home to establish his intent to live abroad permanently and used for a Mexican residency visa with his partner to aid satisfy the Bona Fide Residency Test. In addition, Neil protected a lasting home lease in Mexico, with strategies to ultimately acquire a property. "I currently have a six-month lease on a home in Mexico that I can expand one more 6 months, with the intent to get a home down there." Nonetheless, Neil points out that buying property abroad can be testing without first experiencing the area."We'll definitely be beyond that. Even if we return to the US for doctor's visits or service phone calls, I question we'll invest greater than thirty days in the United States in any given 12-month duration." Neil emphasizes the value of stringent monitoring of U.S. sees (Form 2555). "It's something that people need to be really thorough about," he claims, and advises deportees to be cautious of typical mistakes, such as overstaying in the united state

The 9-Minute Rule for Feie Calculator

tax obligation responsibilities. "The reason that U.S. taxes on around the world earnings is such a large deal is since several people forget they're still based on U.S. tax obligation even after transferring." The united state is just one of the few countries that tax obligations its people no matter where they live, indicating that also if an expat has no income from U.S.

income tax return. "The Foreign Tax Credit rating allows people working in high-tax countries like the UK to offset their U.S. tax obligation liability by the amount they've currently paid in taxes abroad," says Lewis. This ensures that deportees are not strained twice on the same revenue. Those in reduced- or no-tax nations, such as the UAE or Singapore, face extra difficulties.

8 Easy Facts About Feie Calculator Explained

Below are some of the most often asked concerns concerning the FEIE and various other exemptions The Foreign Earned Income Exclusion (FEIE) allows U.S. taxpayers to exclude as much as $130,000 of foreign-earned earnings from federal earnings tax, minimizing their united state tax obligation obligation. To receive FEIE, you should meet either the Physical Existence Test (330 days abroad) or the Bona Fide Residence Test (prove your primary residence in an international nation for a whole tax obligation year).

The Physical Presence Examination likewise needs United state taxpayers to have both an international revenue and an international tax home.

What Does Feie Calculator Mean?

An earnings tax treaty in between the U.S. and another nation can assist prevent dual taxation. While the Foreign Earned Revenue Exclusion lowers taxable earnings, a treaty might supply additional benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a required filing for U.S. people with over $10,000 in international economic accounts.

Qualification for FEIE depends on Find Out More conference particular residency or physical visibility examinations. He has over thirty years of experience and now specializes in CFO solutions, equity compensation, copyright taxes, marijuana taxes and divorce relevant tax/financial planning matters. He is a deportee based in Mexico.

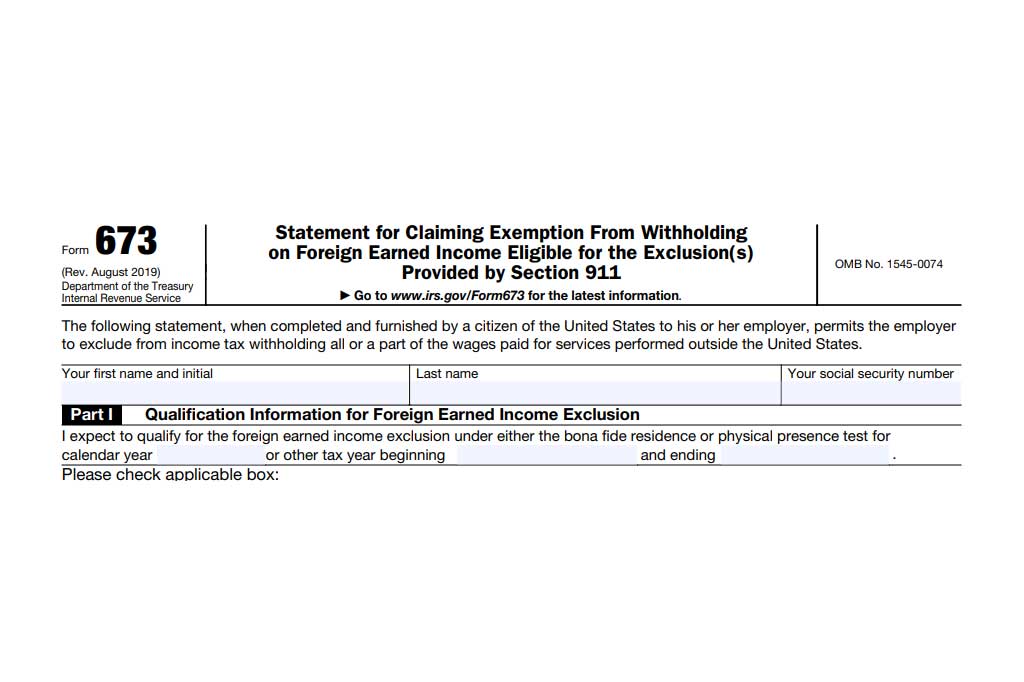

The international earned earnings exemptions, sometimes referred to as the Sec. 911 exclusions, exclude tax obligation on wages made from working abroad.

Not known Facts About Feie Calculator

The income exemption is currently indexed for inflation. The optimal yearly income exclusion is $130,000 for 2025. The tax obligation benefit leaves out the earnings from tax obligation at lower tax rates. Previously, the exemptions "came off the top" decreasing income subject to tax on top tax obligation prices. The exclusions might or may not reduce revenue utilized for various other purposes, such as individual retirement account restrictions, child credit ratings, personal exemptions, and so on.

These exclusions do not spare the salaries from United States taxation but just give a tax reduction. Keep in mind that a bachelor working abroad for every one of 2025 who made about $145,000 without other income will certainly have taxed revenue reduced to absolutely no - effectively the same answer as being "free of tax." The exclusions are computed each day.